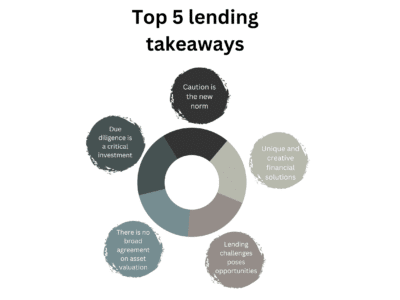

1.Caution is the new norm

Development projects are subjected to increased scrutiny of markets, plans, budgets, schedules and contracts, as well as development and contracting teams. More stringent lending requirements such as letters of credit and personal guarantees have also come into play. New projects and high-end deals are staying on the drawing boards because costs are so high. Taken together, these headwinds will impact project costs, as well as development deal size and frequency, making construction risk management principles more critical than ever.

2.Due diligence is a critical investment

Quality due diligence can go a long way toward mitigating risks. Between stringent environmental regulations, a more meticulous overall approach by cautious lenders, and development on more and more complex sites, environmental, engineering and construction due diligence is an indispensable component of financially profitable commercial real estate development. There is also a surprising number of outdated or obsolete Phase I environmental site assessment reports still in use to quickly satisfy lenders. A knowledgeable due diligence professional can help identify pre-existing structural or environmental issues upfront, and provide cost-effective ways of eliminating problems that only get worse over time.

3.There is no broad agreement on asset valuation

As credit becomes scarcer and more expensive, it’s hard to know exactly what buildings are worth. You get this gap opening up between sellers and buyers: Sellers want to get late 2021 prices and buyers are saying ‘we don’t know what things are worth so we’ll give you this lowball offer.’ That was already happening and the result of that price differential was bringing deal activity down.

There’s no broad agreement on asset valuations. Economic uncertainty will exacerbate that trend. And if you’re a bank, it’s a lot more difficult to lend against the value of a building if you don’t know what the value of the building really is. It becomes more important to be a buyer with a strong investment philosophy and a record of sound fundamentals in asset management.

4.Lending challenges poses opportunities

Medical and life sciences offices, where remote work is less common and with fast-growing demand, have outperformed traditional office space.

Steady industrial activity has made this sector attractive despite concerns of a recession.

Strong consumer demand has fueled business growth and further demand for retail spaces, but has also resulted in higher inflation.

The aging U.S. population and longer life expectancies, demand for senior housing is only expected to increase. Similarly, consumers are increasingly spending on services such as restaurant dining and vacations, increasing the demand for qualified hospitality workers. In turn, this has helped these CRE sectors.

Multifamily housing remains strong. However, just like the industrial property market, new supply is coming online which could eventually place pressure on rent prices.

What do these mean for borrowers = well capitalized, sound credit opportunities!

5.Unique and creative financial solutions

A trusted banking partner can help CRE companies create customized, creative solutions to their strategic financing needs. For instance, they can help to understand the duration risk of a loan portfolio and propose a range of possible solutions for borrowers, even if interest rates remain elevated. Creative leasing options can also provide for financing flexibility.